With many solar installations costing tens of thousands of dollars, a solar project is a significant investment for most customers. Fortunately, there are a number of financing options to help clients install solar without breaking the bank. Navigating the decision-making process, however, can be daunting for those unfamiliar with solar finance.

In today’s article, we provide a basic primer on the ways solar installations can be financed. In the next article in this series, we’ll look at each approach—and the benefits and limitations—in greater detail.

As a solar installer, being able to walk your customer through these options can make the difference in closing the sale. Additionally, it can make good business sense to work with financing partners to offer a variety of choices to meet your customer’s needs. Having familiarity with these financing options will allow you to evaluate potential partnerships.

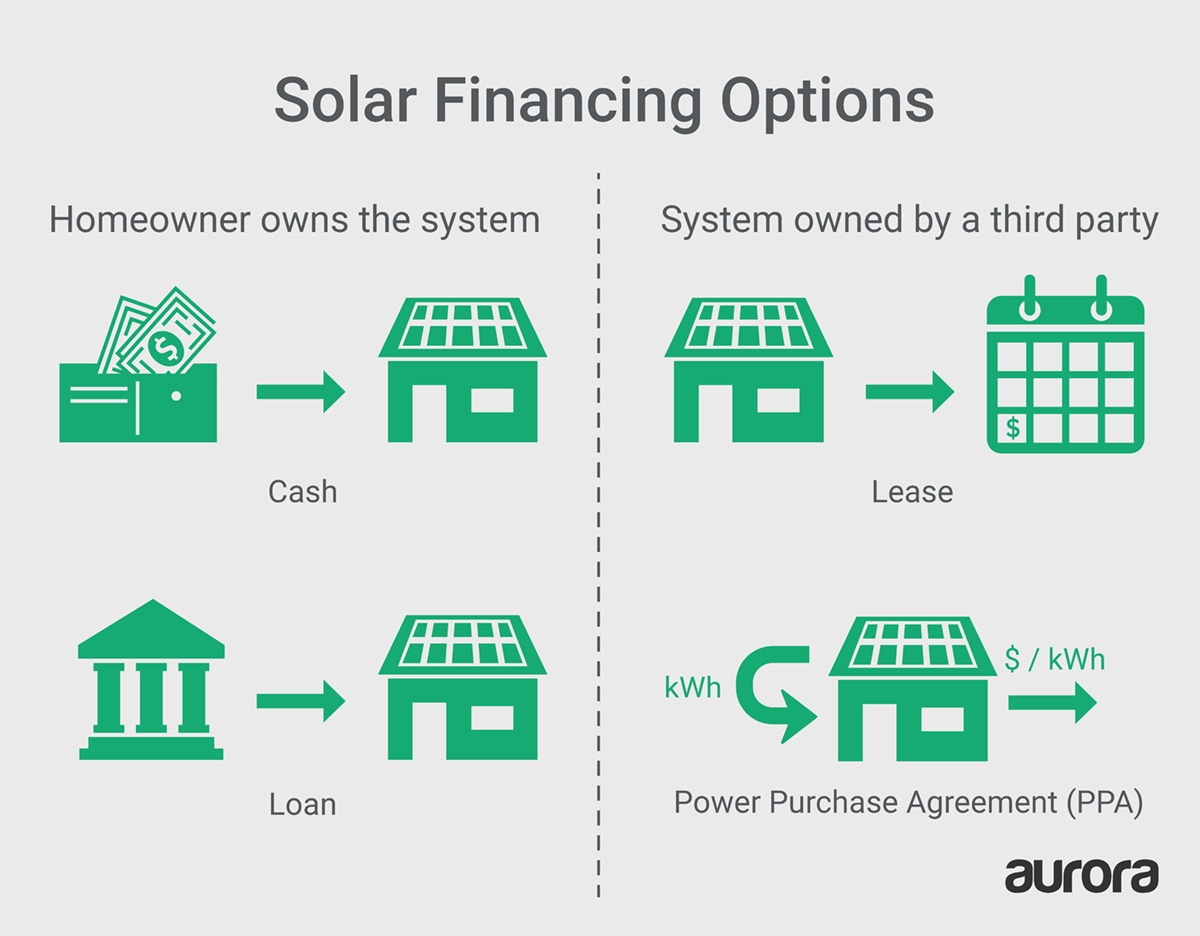

Who Owns the Solar Installation?

How important is it to your customer that they own the solar project? This is one of the major considerations when choosing a financing option. With cash and loan financing, the customer will own both the PV system and the power it produces. With other financing options, like leases and power purchase agreements, the solar installation will be owned by a third-party, but the customer will have the right to the energy it produces. Ownership has pros (like tax benefits) and cons (like responsibility for maintenance).

Whoever owns the system can take advantage of federal and state tax incentives. This includes the Investment Tax Credit (ITC) which allows 30% of the cost of the system to be deducted from the owner’s federal taxes. However, for this to be helpful, the owner must owe more in taxes than the ITC allows them to deduct (in other words, they must have enough tax liability). Customers without enough tax liability may find third-party ownership options preferable.

As a solar installer, being able to walk your customer through these options can make the difference in closing the sale.

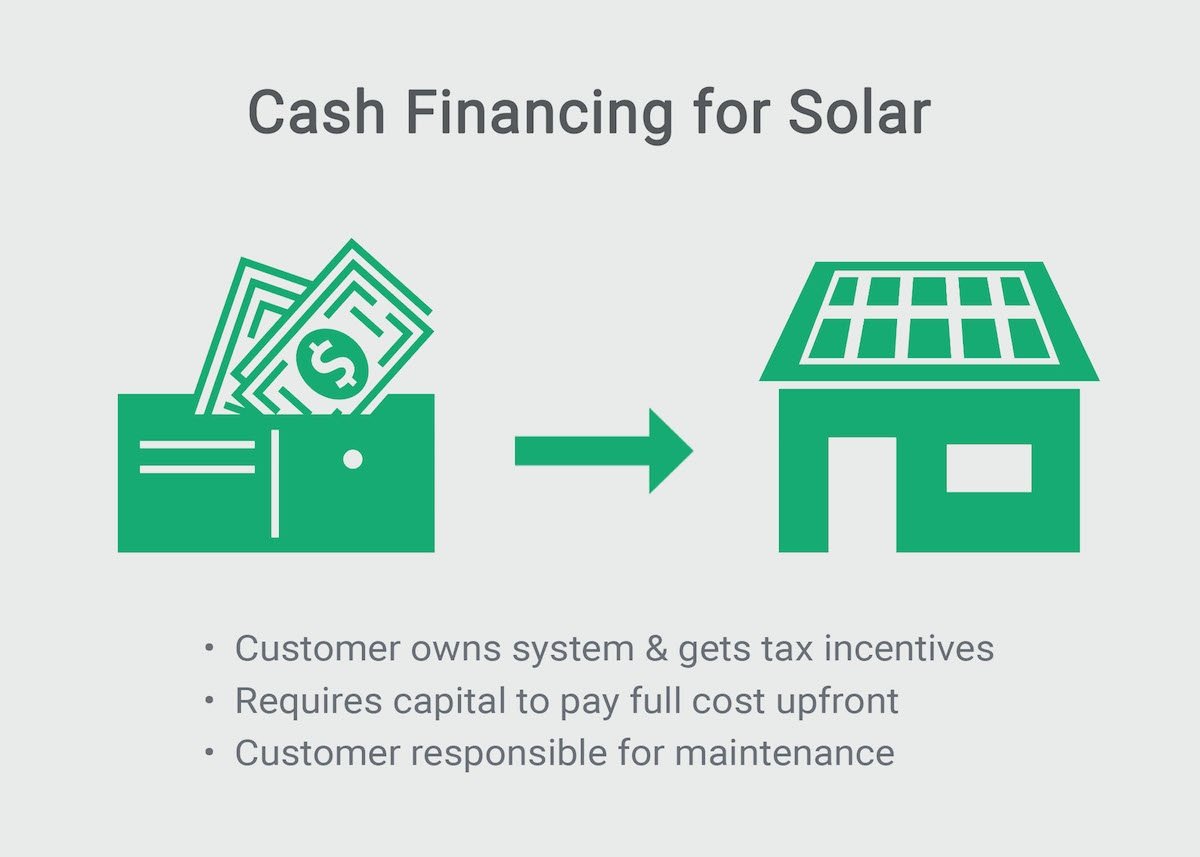

Cash Financing

For those who can afford to pay for the system upfront, cash financing is a great option. Cash is typically the cheapest choice in terms of total cost because the customer is not subject to interest payments or other fees. It also allows customers with sufficiently large tax bills to save by reducing their tax liability. The obvious drawback to cash financing, however, is that the customer needs to have enough cash on hand to pay for the system outright.

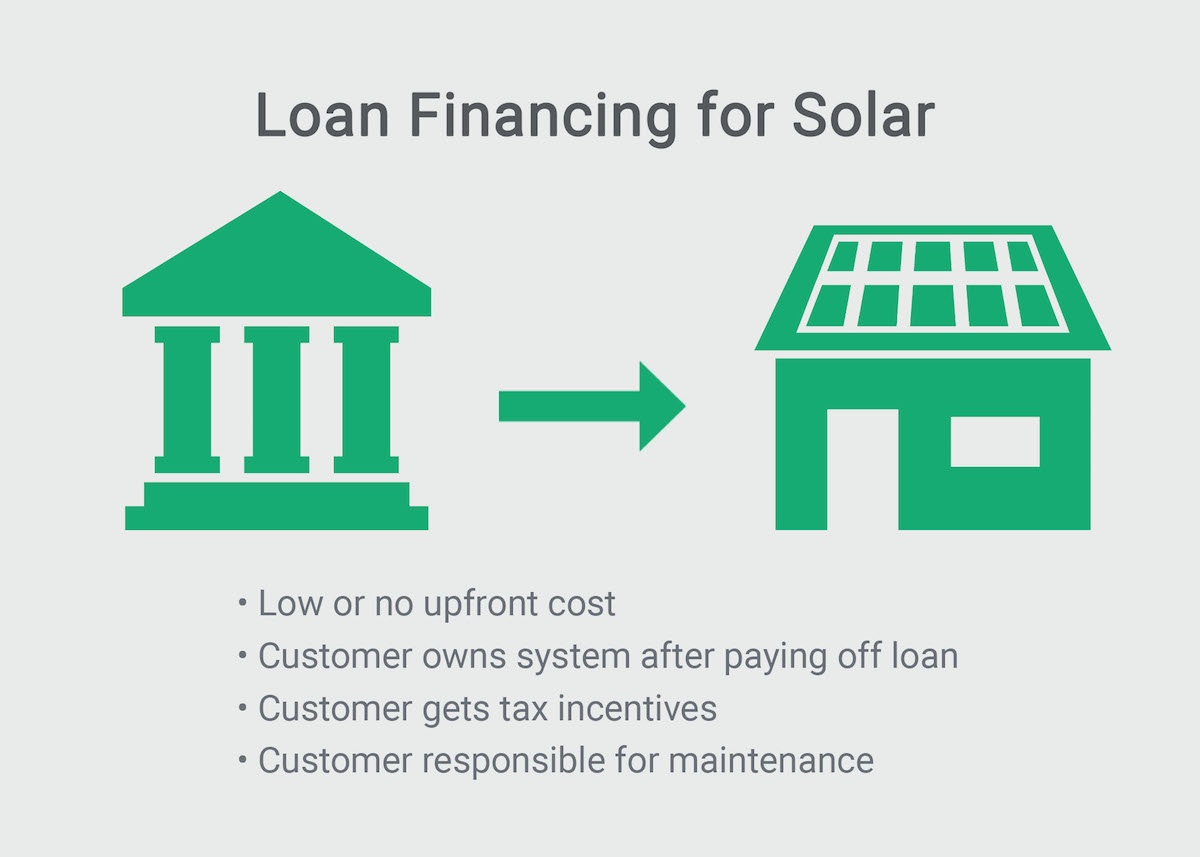

Loan Financing

Loans are a good option for customers who want to own their system, but cannot or prefer not to pay for it entirely upfront. A loan can be used to finance any part of the project, depending on how much the customer is willing to pay initially. As with cash deals, loans allow customers to take advantage of tax incentives.

Solar loans have the same basic parameters as other home renovation loans: the lower the interest rate, the lower the overall cost, and the shorter the term of the loan, the higher the monthly payments. A key consideration for loan financing is that the monthly savings from solar should be greater than the monthly loan payments so the customer can save money from the start.

Another form of solar loan is Property Assessed Clean Energy (PACE) financing. PACE loans are repaid through the homeowner’s property taxes. These loans are offered by some municipal governments in states with enabling legislation.

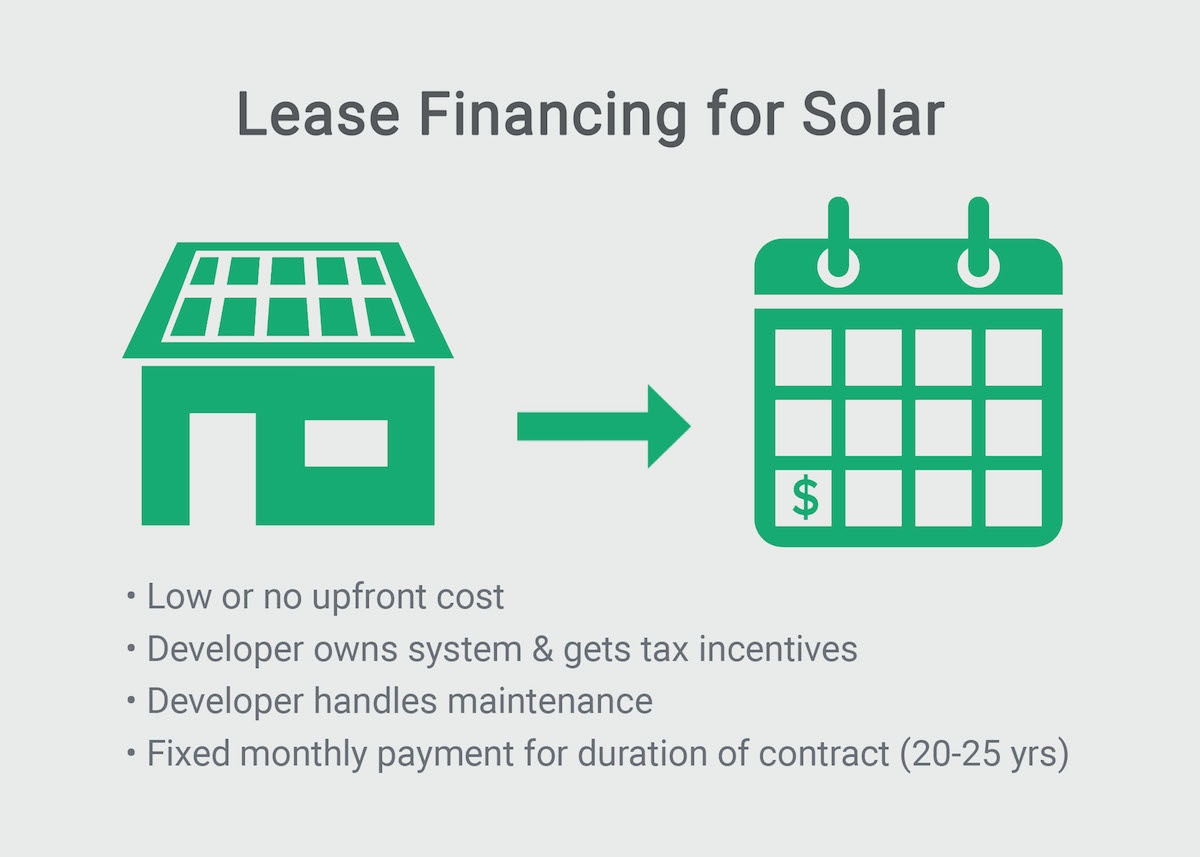

Third-party Ownership: Solar Leases and Power Purchase Agreements (PPAs)

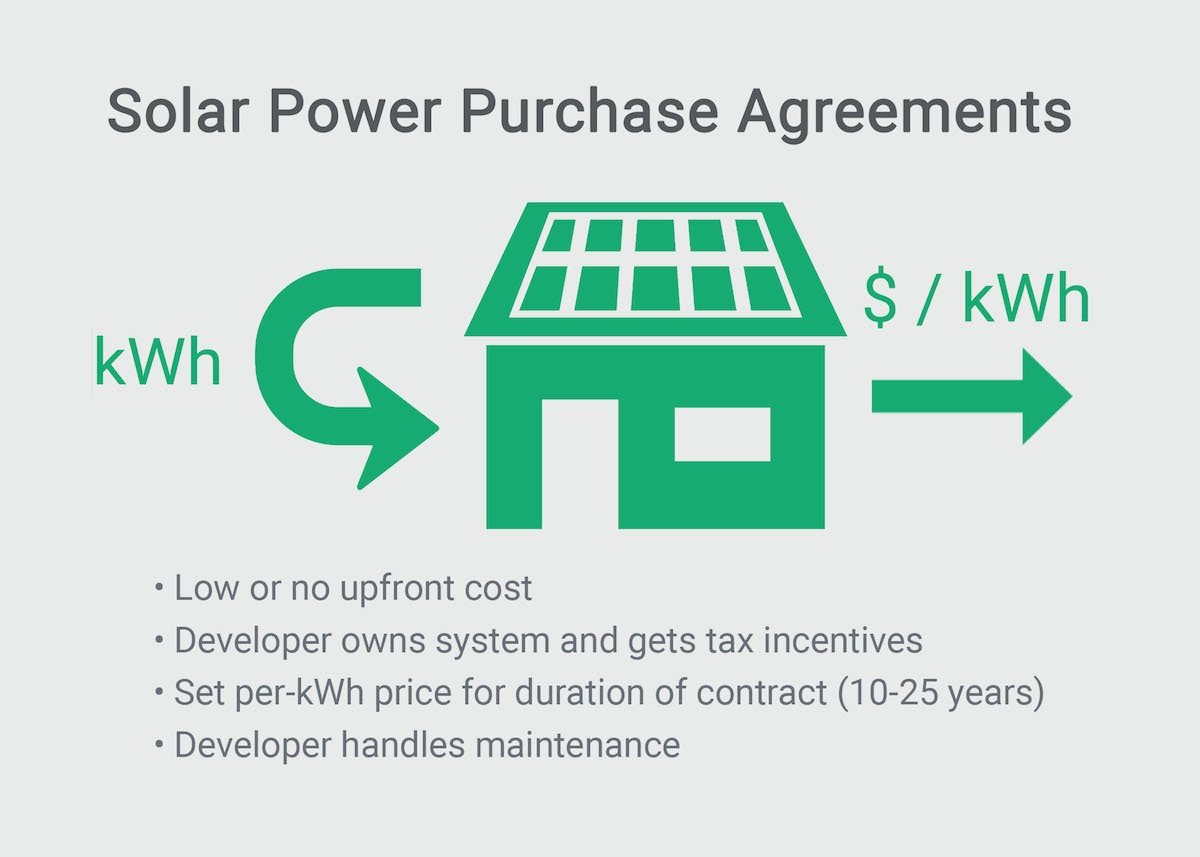

Leases and power purchase agreements (PPAs) can be thought of as similar to renting a solar installation. By signing a contract with a project developer, the customer is entitled to the energy the system provides for a set period of time, but ownership and the right to tax incentives are retained by the developer. In both cases, the project developer (owner) is responsible for maintaining the system and monitoring how much energy it produces. As with loans, a key consideration is that the monthly payments should be less than the resulting utility bill savings.

In practice, solar leases and PPAs are similar, but there are technical differences:

With a lease, the customer pays a fixed monthly amount, which is calculated based on the estimated amount of electricity the system will produce. This monthly payment entitles the customer to the resulting solar energy for the duration of the contract. Solar lease contracts typically span 20 – 25 years.

With a PPA, the customer agrees to purchase the power generated by the system at a set per-kWh price. This may be a fixed price for the length of the contract or the per-kWh price may increase at a specified rate over time. This escalation is typically lower than projected utility rate increases. PPA contracts typically span 10 – 25 years. PPAs are less common than solar leases because of legal barriers in some states .

Solar leases and PPAs can be a good option for customers who prefer to have little or no upfront cost, and who don’t have enough tax liability to benefit from incentives like the ITC. They are also a good option for customers who want the peace of mind of knowing they don’t have to maintain or monitor the performance of their solar installation.

Each of these financing options can save customers money on their energy bills, and each can be a great fit depending on your customer’s needs. Being able to provide your customers with a simple overview of the primary finance options can help demystify the process of installing solar. It’s also important as a business owner to have a high degree of familiarity with these financing approaches so you can decide which you may want to help connect your customers with through partnerships with financial institutions. Read on to the next article in this series for a discussion of some of the factors customers should consider when choosing which financing option best meets their needs.

Key Takeaways:

- The four main financing options for solar installations are cash, loans, leases, and PPAs. All of these options can help homeowners save money on their energy bills and each can be a good choice depending on the needs of the customer.

- With cash and loan financing, customers will own the solar installation and, if they owe enough in taxes, can benefit from tax incentives.

- Solar leases and power purchase agreements (PPAs) are similar in practice to renting a solar installation; the customer benefits from the solar energy (which they purchase at a set price, typically below the retail rate for electricity), but does not own the installation.

About Solar Finance 101

Your Solar Finance Primer: What to Know About the Top Four Solar Financing Options is Part 2 of Solar Finance 101, a five-article series that serves as an introductory primer on the financial considerations of solar installations:

Article 1: How Solar Customers Save Money: A Beginner’s Guide to Net Energy Metering

Article 2: Your Solar Finance Primer: What to Know About the Top Four Solar Financing Options

Article 3: Evaluating Solar Financing Options: Factors for Your Customer to Consider

Article 4: Financial Incentives for Installing Solar: A Beginner’s Guide

Article 5: Quantifying Value of a Solar Installation: Some Helpful Metrics